Credit unions have the choice of being chartered by the state or federal government. The United States has the strongest and most innovative banking system in the world, in large part because of this choice. It creates a healthy dynamic tension among regulators, resulting in a wider range of products and services available to consumers, lower regulatory costs, and more effective, more responsive supervision.

Formation of the Dual Charter System

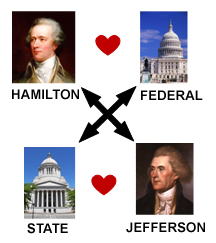

- From the beginning, there have been advocates of centralized vs state-chartered banking.

(History: The First Bank of the United States was a central bank chartered in 1791 by the U.S. Congress at the urging of Alexander Hamilton. The bank faced criticism from the likes of Thomas Jefferson who believed powers not expressly mentioned in the Constitution were reserved to the states.)

- This dynamic tension has evolved into the dual banking system that we have today.

Birth of the State Credit Union Charter

Credit unions in the United States (U.S.) started as state chartered credit unions. The first U.S. credit union was organized in 1908, and chartered in 1909 under a special act of the New Hampshire legislature. In 1933, the Washington State legislature sent House Bill No. 240 to Governor Clarence Martin and the Governor approved the Washington Credit Union Act on March 20, 1933.

Birth of the Federal Credit Union Charter

In 1934, the Federal Credit Union Act was enacted; the dual chartering system was born and continues to exist today. Under the dual charter system, state and federal regulators are the guardians of credit unions and help ensure the public's confidence in the financial services system that is vital to any state's economic destiny. Credit unions in the U.S. have deposit insurance. The shares and deposits at our Washington state credit unions are insured by the National Credit Union Share Insurance Fund (NCUSIF). The NCUSIF is administered by the National Credit Union Administration (NCUA), a federal agency that insures deposits similar to the Federal Deposit Insurance Corporation for banks.

Current Regulatory Structure

The current regulatory structure includes a state agency from each state that serves as the chartering authority and primary regulator for state licensees. The State of Washington Department of Financial Institutions (DFI) serves in that capacity for credit unions. The National Credit Union Administration (NCUA) serves as the chartering authority and primary regulator for federal credit unions.

Dual Chartering System

- State Charter

State chartered credit unions are regulated by the Washington State Department of Financial Institutions (DFI). - Federal Charter

Federally chartered credit unions are regulated by the National Credit Union Administration (NCUA).

The dual chartering system provides a charter choice for credit union management to exercise based on available powers, geographic concerns, accessibility of regulators, regulatory philosophy, and costs.

According to the National Association of State Credit Union Supervisors (NASCUS), state credit unions represent about 39% of the number of all credit unions in the United States. Based on the National Credit Union Administration aggregate data, over 45% of credit union assets are held in state chartered credit unions.

The competitive nature of the dual chartering system has prompted individual states to be responsive to the needs of their constituent credit unions and citizens, thereby resulting in new products and powers. A choice of charter forces regulators to update and improve examination techniques and examiner training, maximize efficiency and control costs for fear that supervised institutions might abandon them out of frustration. Moreover, regulatory authorities are encouraged to take a healthier, more positive posture on financial innovation and risk-taking when there are charter alternatives.

Studies have actually argued that not having both federal and state charters would inhibit financial services competition and its benefits for consumers. Dual chartering allows the system to work together on common challenges affecting the entire system and the continued strength and growth of credit unions. It ensures that the federal and state credit union systems challenge each other to constantly improve.

While overlapping federal and state regulators can appear to the uninformed to constitute duplication; the dual system actually provides checks and balances between two levels of government and helps to ensure the decentralization of decision-making power. It serves as a safety valve against concentration of power in the hands of a few decision-makers, who can become imperceptive or complacent, and against the potential for abusive or simply unwise actions or oppressive regulation.

Advantages of State Charter

- Local Perspective on Financial Issues

State regulators provide a "local" perspective and tend to keep a "state" focus on financial issues that impact the state's economy. Whereas, the "Washington DC" perspective, by its nature, does not always consider individual state needs. States have a unique perspective that is not always shared at the federal level. The smallest credit union failure in the smallest town may not drive policy in Washington DC or impact Wall Street, but may have a devastating impact upon the community the credit union serves. - Strengthen Local Economies

Safety and soundness supervision is about local economies and communities. By ensuring the success of local credit unions, state regulators are also strengthening local economies. Therefore, state regulators must have an equal voice with the federal regulators in the development of regulatory policy and supervision decisions that affect credit unions. - Local Consumer Protection and Assistance

The dual chartering system enables state governments to apply state laws and regulations that ensure consumer protection, that serve the needs of local economies and that respond to the values and concerns of local citizens, thus, encouraging diversity and innovation. It is the state regulator that answers to and carries out the mandates of state government.

State and Federal Regulators Work Together

The decentralization of decision-making in regulation has created an environment where state and federal legislative bodies and regulators must work together on regulatory and other policy matters that enhance financial services and supervision. There are many examples of state-federal cooperation. State and federal legislative bodies worked together to form the basis for first regional and then nationwide interstate banking. State-federal regulatory working groups operate across the nation on an ongoing basis to detect and deter fraud and share regulatory findings.

Often, state regulators are made aware of troubling practices, trends, or warning signs before the federal regulators can identify these emerging issues. State regulators and legislatures then respond quickly, which enables federal regulators and Congress to learn from the state experience to develop uniform and nationwide standards or best practices. Other examples include the development of consistent supervisory examination reports across state and federal regulatory agencies.

State and federal regulatory agencies also accept each other's examination reports as if they were their own, and share examination report software and other technology, reducing the potential duplication of effort that could occur if there was not a high level of cooperation between them. The dual chartering system is not unlike the vision of our country's founders, who established a system of government that divides power and responsibilities between the state governments and the central government.

Resources

- Dual Charter and the Benefits of State Charter

California Department of Financial Institutions - The Case for Dual Chartering (PDF)*

Published by the National Association of State Credit Union Supervisors - Your Insured Funds (PDF)*

Published by National Credit Union Administration (NCUA) - State Credit Union Facts and Figures

Published by the National Association of State Credit Union Supervisors